quicken tax planner problem

If installing the patch doesnt resolve the issue continue to Step 3. Compare 2022s Best Tax Relief Companies to Help You Get Out of Taxes.

How To Fix Quicken Error Code 1603 In 2020 Quicken Online Backup Coding

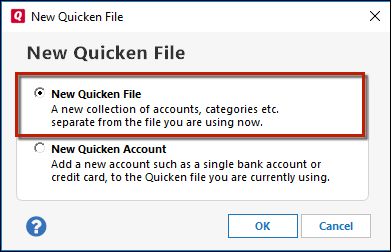

Try completing the Validate steps above in the prior version first then convert the file.

. Get the insights you need to manage your finances. Taxable social security is another value that requires special treatment in Quicken but since you indicated Taxable Income matched up it is not likely a factor in your case. In August 2020 Quicken moved from a Bill Pay platform to a new platform called Quicken Bill Manager.

This lets you keep track of your current debts and create a plan to pay them off. It helps you project out how. Ray Cosner Member.

You can manually enter projected amounts for information you choose not to track in Quicken remember to enter a full years worth. Up to 5 cash back Manage your spending and save Stay on top of your spending by tracking whats left after the bills are paid. Business Tags affect Tax Planner Data.

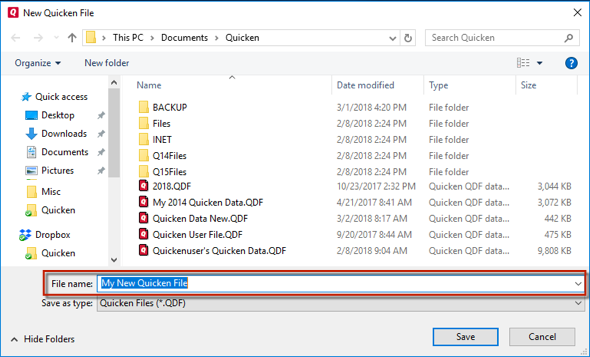

Specifically its not saving Scheduled Bills and Deposits under Other Income or Losses Its also not saving Scheduled Bills and Deposits under Withholdings. Ad A comprehensive financial planning tool to manage expenses investments more. Choose Reports menu Tax Tax Schedule or Capital Gains.

Check what your balances will be after paying bills. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. For some reason I cannot get the Tax Planner to save certain settings.

Tax Planner Error - again. Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of the form seems to be. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner.

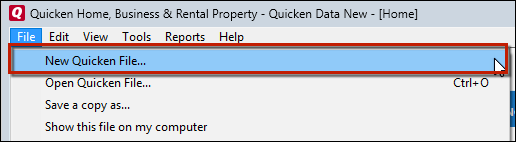

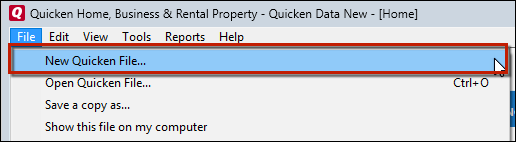

Click Lets get started at the bottom of the Tax Planner window. After installing the patch restart your computer. In the Save in field select a location for the file.

In Errors and Troubleshooting Windows Tax Planner in two categories shows a correct total in the detail transaction breakout but carries an incorrect total to the summary at the top of the category page and to the overall tax calculation. Tax Planner Inconsistency. Take a look at TurboTax form 1040 Line 3a and insert the value for QDI into Tax Planner.

The problem here is that whether you use Mobile Sync or not to connect to your mobile or tablet device there still seems to be some of your data on the Quicken Cloud. Verify that the data is accurate and make any necessary changes. Choose Export Data To tax export file.

Choose Tax Tools Tax Planner. Ad Forgot to File Your Taxes. Click Customize in the upper-right corner of the report to customize the report to show the data you want to export to your tax software.

The projected tax in the planner should converge with TurboTax. An issue where matching a manual transaction to a downloaded transaction did not retain the Tag or Attachment from the manual transaction. Read the on-screen instructions.

But I do note that the Tax Schedule report and the Schedule E report will both indicate a problem when there is no Property tag assigned to any Schedule E. Keep in mind that Quickens Tax Planner is not intended as a tax-calculation tool. Reply to John Pollard Site Timeline Corporate Securities Spinoff.

If youve recently upgraded to a new version of Quicken If you have purchased and installed a new version of Quicken and there are issues with your data such as missing or incorrect totals there may have been a problem with the conversion. Select your Quicken version year and then download and install the update patch. Users who NEVER sync to mobile are finding that transactions from the Quicken Cloud are being deleted changed unreconciled or altered without any previous knowledge or warning.

Make more informed money decisions by creating custom budgets youll stick to. Make tax season less taxing with Quicken. Our scheduled deposits have been meticulously built using the Paycheck Wizard.

Instead the purpose of the Planner is to give you a snapshot of your tax situation throughout the year. The discrepancy is large about 50k. These Tax Relief Companies Can Help.

Easily view and manage your bills See where money is coming in and how much is going out from your accounts. I can get Tax Planner to come within a. You can update this information as you work through the Tax Planner wizard.

In Tax Planner under Withholding - Self the annual total in the Details box is not the total that is carried forward to the summary screen at the top of the page. Using the previous example if you wanted to view your 2021 data in Quicken instead of 2022 click on the link for year in the top left and change it to 2021. When you select one of the lines at the top of the screen say Wages and Salary Self then click Show Details at the bottom of the screen you can see the actual and scheduled transactions that the planner is using for that summary amount at the top of the screen.

An issue where for some users the Filing Status in the Tax Planner was not being saved. Quicken yearly budget Quicken also includes on this tab is Debt Reduction calculator. Get 40 Off Quicken Today.

An issue where a prompt to enter a Password Vault password could not be dismissed. Try opening Quicken without a data file. To get the most accurate estimate of your taxes you might decide to fine-tune the values in the Tax Planner.

I am currently unable to use the Quicken Tax Planner. Click the Planning tab and then click the Tax Center button. To do this hold Ctrl Shift on your keyboard and double-click the Quicken icon.

The difference is about 3000 detailed list shows more withholding.

Quicken Phone Support By Certified Experts Live Quicken Experts For Help Helpline 1866 209 3656 For Qu Tax Software Best Tax Software Online Accounting Courses

How To Fix Quicken Error Cc 506 Quicken Windows Registry Technical Glitch

Get Quicken Support Service Assistant Instantly Without Any Hassle Supportive Quicken Support Services

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Quicken Support Phone Number 1877 980 4312 24 7 By Quicktech Solution Quicken Phone Support Accounting Software

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

My Incredimail Not Working Incredimail 2 5 Crashing Contactforhelp Work Fun Easy Solving

Pin By Erica Thomas On Sameer Managing Your Money Quicken Better One

Dial Quicken Support Number Fix Issues In Tax Investments Investing Quicken Accounting

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Pin On Quicken Helpline Number

Get Quick Support By Quicken Professional Support Team Quicken Supportive This Or That Questions

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Estimated Tax Math In Planner Seems Incorrect Quicken

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Quicken Update Fails Quicken Update Not Working How To Fix Quicken Errors Solution

Blog Page 6 Of 19 Currace Quicken Words Containing Quickbooks

Quicken Phone Support Number By Experts Certified Accounting Experts Are Here To Help You Dial 1866 Accounting Software Financial Information Business Support